An FD calculator is used to calculate the final amount that you will receive if you invest in a fixed amount (FD) with a given amount, rate of interest and given a given period of investment.

When you start your investment trip, a fixed deposit (FD) is often the first choice for your safety and guaranteed returns. A simple tool is an FD calculator to help you with it. This provides a clear, no-surprise projection of your returns. However, for people with a long -term vision, understanding the ability of an SIP (systematic investment plan) is equally essential. While an FD calculator is about fixed returns, an SIP calculator is your key that unlocks market power for correct money creation.

What is an FD Calculator?

An FD calculator is a user friendly online tool designed to calculate the maturity amount and interest earned on a fixed deposit. Fixed deposits are a safe investment, where you submit a lump sum for a fixed period for a certain period of time at a prescribed interest rate, offered by banks and NBFCs. By inputting details such as the original amount, tenure and interest rates, an FD calculator immediately reflects your potential return. This eliminates the requirement of manual calculations, making it ideal for both new and experienced investors who plan their savings effectively.

How Can an FD Calculator Help You?

An FD calculator is a powerful device that simplifies financial planning. Here’s how it can benefit you:

- Quick and accurate results: This provides the accurate estimate of your FD maturity amount, which reduces the risk of errors by manual calculations.

- Saves time: Complex interest calculation is done in seconds, which is freed you to focus on other financial decisions.

- Compare FD options: You can compare various banks FD schemes to find the most attractive option.

- Goal-Oriented Planning: Whether saving for home, education, or retirement, the calculator helps to align your FD with your financial goals.

- Scenario Analysis: Use various major quantities, tenure and interest rates to customize your investment strategy.

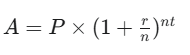

The Formula to Determine FD Maturity Amount

FD calculator depends on the compounding interest formula, as most banks have given quarterly compounding interest. The formula is given below:

Where

- A = Maturity Amount

- P = Principal Amount

- r = Annual Interest Rate

- t = Tenure in years

- n = No. of compounding periods per year

Ex: If you invest ₹ 5, 50,000 at 7.5% p.a for 3 yrs. with quarterly compounding:

A = 5, 50,000 * (1.00625) ^ (12*2)

A = 5, 50,000 * (1.0175) ^24

A ≈ ₹834,043

The maturity amount is approx. ₹834,043.53, with interest of ₹284043. A Fixed Deposit calculator automates this process, delivering instant, error-free results.

How to Use FD Calculator?

The use of FD calculator is straightforward and requires minimal effort. Steps are given below:

1. Use the calculator: Go to a reliable financial platform such as Groww, Cleartax, or a bank website (eg, SBI, ICICI) and find out the FD calculator.

2. Input Principal amount: Enter the investment amount you want to invest.

3. Specify the tenure: Select a period of Fixed Deposit, such as 6 months, 1 year or 5 years.

4. Enter the interest rate: Input the annual interest rate given by bank/NBFC. Some calculators to auto-populate rates for specific banks.

5. Select compounding frequencies: Choose monthly, quarterly, or annual compounding (quarterly common).

6. Calculate: Click on the “Calculation” button to see maturity amount, earned interest, and a wide breakdown immediately.

This process takes less than a minute, making it accessible to those new people as well.

Fixed Deposit Interest Rates of Different Banks (September 2025)

| Bank/NBFC | Tenure Range | Citizen Rates (% p.a.) | Senior Citizen Rates (% p.a.) |

|---|---|---|---|

| Slice Small Finance Bank | 7 days – 10 yrs | 3.50 – 8.50 | 4.00 – 8.50 |

| Utkarsh Small Finance Bank | 7 days – 10 yrs | 4.00 – 7.65 | 4.50 – 8.15 |

| Shivalik Small Finance Bank | 7 days – 10 yrs | 3.50 – 7.60 | 4.00 – 8.10 |

| ESAF Small Finance Bank | 7 days – 10 yrs | 3.00 – 7.60 | 3.50 – 8.10 |

| Ujjivan Small Finance Bank | 7 days – 10 yrs | 3.50 – 7.45 | 4.00 – 7.95 |

| Equitas Small Finance Bank | 7 days – 10 yrs | 3.50 – 7.40 | 4.00 – 7.90 |

| Bandhan Bank | 7 days – 10 yrs | 3.00 – 7.20 | 3.75 – 7.80 |

| DCB Bank | 7 days – 10 yrs | 3.75 – 7.20 | Not specified |

| SBM Bank (Private) | 5 years | Up to 7.50 | Not specified |

| Central Bank of India | 444 days | Up to 7.00 | Not specified |

| Bajaj Finance (NBFC) | 12 – 60 months | Up to 6.95 | Up to 7.30 |

| ICICI Bank | 7 days – 10 yrs | 2.75 – 6.60 | 3.25 – 7.10 |

| HDFC Bank | 7 days – 10 yrs | 3.00 – 7.00* | 3.50 – 7.50* |

| Axis Bank | 7 days – 10 yrs | 3.00 – 7.00* | 3.50 – 7.50* |

| IDFC FIRST Bank | 7 days – 10 yrs | 3.00 – 7.00* | 3.50 – 7.50* |

| Indian Bank | 7 days – 10 yrs | 3.00 – 6.75* | 3.50 – 7.50* |

| State Bank of India (SBI) | 7 days – 10 yrs | 3.00 – 6.60 (444 days: 6.60) | 3.50 – 7.10 (444 days: 7.10) |

| Bank of Baroda | 7 days – 10 yrs | 3.00 – 6.75* | 3.50 – 7.25* |

| Union Bank of India | 7 days – 10 yrs | 3.00 – 6.75* | 3.50 – 7.50* |

| IDBI Bank | 7 days – 10 yrs | 3.00 – 6.75* | 3.50 – 7.25* |

| IndusInd Bank | 7 days – 10 yrs | 3.00 – 7.00* | 3.50 – 7.50* |

| Federal Bank | 7 days – 10 yrs | 3.00 – 6.75* | 3.50 – 7.25* |

Note: FD tenures typically range from 7 days to 10 years. The rates are subject to change as per the policy of the banks

Advantages of Using FD Calculator India

The main advantage of an FD calculator in the Indian context is its role in providing clear financial foresight. It is a reliable tool for investors that prefer capital security on high returns. However, for people with high risk hunger and a long investment horizon, it is also important to take advantage of an SIP calculator. It imagines the ability of equity mutual funds to improve traditional fixed-incredible options. This dual approach helps investors to make an informed decisions and create a balanced portfolio.

FAQs about FD Calculator

Can an FD calculator be used for all banks?

Yes, as long as you input the exact details (principal, tenure, interest rate, compounding frequency), the calculator works for any bank or NBFC. See the bank website for current rates.

How is an FD calculator different from an SIP calculator?

An FD calculator estimates that a one -time fixed deposit returns, while an SIP calculator project returns to regular mutual fund investment. They take advantage of both but complete various investment types.

What FD calculator requires registration to use?

No, most FD calculators (eg, Groww or Cleartax) are independent and do not require registration, although some platforms can provide additional features for registered users.

Can I calculate premature return punishment?

FD calculators usually do not have factors in punishment. Check the bank’s policy (usually 0.5% -1% lower rate) and manually adjust the interest rate for estimates.

Using FD calculator simplifies your investment journey, which helps you to make confidence, data-managed decisions to develop your money safely.

Know about SIP Calculator