Do you want to build money systematically and get your financial dreams? Then you are likely to cross the word “SIP” – Systematic Investment Plan. And if you are serious about making informed investment decisions, it is absolutely necessary to understand and use the SIP calculator. This powerful online tool can be your best friend to imagine your future wealth and make your investment journey smooth and more strategic.

What is a SIP Calculator?

At its core, a SIP calculator is an online tool designed to help you guess the money that you can deposit by investing a certain amount regularly in a mutual fund through a systematic investment plan (SIP). An SIP is a method of investment where you invest a certain amount at regular intervals, such as monthly or quarterly. This disciplined approach helps you benefit from compounding and the cost of the rupee average.

Think of SIP calculator as a financial simulation tool. You provide it with some major information, and it gives you a projection of the future value of your investment. This helps you understand the relationship between your investment amount, investment tenure and the expected rate of return. This is an indispensable tool for a long -term financial plan, whether you are saving for your child’s education, a down payment at a home, or your retirement.

How Does a SIP Calculator Work?

The magic of an SIP return calculator lies in its simplicity and powerful financial principles, which is primarily the concept of compounds. Here is the breakdown of major inputs and how it processes them:

- Monthly Investment Amount: This is a fixed amount that you plan to invest regularly, usually every month. Even a small amount, consistent invested, can cause adequate money over time.

- Expected Annual Rate of Return: This is an estimated average annual percentage return that you anticipate from your investment. It is important to remember that this is an estimate, as the actual market returns may be different. Financial advisors often suggest using the historical average of funds you are considering for a realistic projection.

- Investment Tenure: This is the period for which you plan to continue your SIP investment. The longer your investment horizon, the greater the effect of compounding.

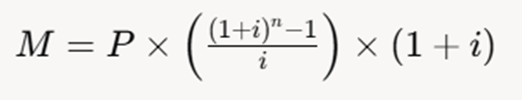

Input these three values into the SIP calculator, it uses a specific formula to project your future money. The most common formula is:

Where:

- M = Maturity amount

- P = Monthly SIP investment amount

- n = Number of installments (investment tenure in years × 12)

- i = Compounded rate of return per month (annual rate of return / 12 / 100)

The calculator then quickly performs these complex calculations, presenting you with the estimated total amount invested and the estimated wealth gained.

How Can a SIP Return Calculator Help You?

A SIP Return Calculator is more than only a calculation tool. This is a strategic aid for the smart financial plan. Here’s how it can strengthen you:

- Goal-Based Planning: Whether you are saving for a down payment, your child’s education, or a comfortable retirement, an SIP calculator helps you in backward work. You can input your desired future value and adjust your monthly SIP amount or investment tenure to see what it takes to reach your goal. This makes the “investment plan” very tangible.

- Understanding Compounding: It beautifully shows “magic of compounding”. By showing you how your return returns, it emphasizes why starting early and investing for a long time increases your money

- Comparing Scenarios: You can easily compare different investment scenarios. What if you increase your monthly SIP by ₹ 1,000? What if you extend your investment period by five years? The calculator provides quick answer, which helps you optimize your investment strategy.

- Realistic Expectations: While it provides estimates, it helps determine realistic expectations about potential returns. This prevents disappointment and encourages a disciplined approach to invest.

FAQs on SIP Calculator

Is SIP calculator accurate?

A SIP calculator provides estimates based on the input provided by you. While the calculation itself is accurate, “the expected annual rate of returns” is an assumption. Actual market returns can be different, so consider the results as estimates rather than guaranteed data.

What is a good expected rate of return to use?

A good expected rate of returns depends on the type of funds (eg, equity, debt) and historical performance. For equity mutual funds, many investors use historical average, often ranging from 10% to 15%, but it must be carefully selected on the basis of your research and risk hunger

How many times should I check my SIP calculator estimates?

While it is not necessary to do a daily investigation, it is a good idea to see your estimates from time to time, especially when your financial goals change, your income increases (allowed for higher SIPs), or there is considerable change in market conditions.

Can I modify my SIP amount after starting?

Yes, most mutual fund houses allow you to increase, reduce or stop your SIP at any time, although there may be a short processing period. You can then use SIP calculator to accommodate your new estimates.

What is the difference between SIP and lump sum calculator?

A SIP calculator handles periodic investments, while a lump sum calculates an increase on the same amount. Both are types of investment calculators, but SIP has suits salaried persons.

Can I use SIP calculator for date funds?

Yes, but the required returns are less (about 6-8%) compared to equity funds (10–15%). Adjust the rate accordingly for accurate SIP returns.

Harness the power of the SIP calculator today to visualize your financial growth and take confident steps towards achieving your investment goals. This is a simple tool in which there is a large scale difference in your wealth creation journey.